Irs Tax Tables 2024 Pdf 1040. The 2024 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2023 tax year. The standard deduction for single taxpayers will be.

Tax tables for the 2024/25 tax year here. But there are other important tax deadlines to know as well.

The Standard Deduction For Single Taxpayers Will Be.

But there are other important tax deadlines to know as well.

Second Payment On Account For 2023/24 Income Tax And Class 4 Nics.

August 2024 1 penalty of 5% of the tax due or £300, whichever is the greater, where the 2022/23 tax.

Individuals, Estates, Etc £3,000 £6,000 Trusts Generally £1,500 £3,000 Below Uk Higher Rate Band:

Capital gains tax 24/25 23/24 annual exemption:

Images References :

Source: www.taxuni.com

Source: www.taxuni.com

Federal Withholding Tables 2024 Federal Tax, Second payment on account for 2023/24 income tax and class 4 nics. The 2024 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2023 tax year.

Source: powerpointban.web.fc2.com

Source: powerpointban.web.fc2.com

How do you find the current IRS 1040 tax table?, Individuals, estates, etc £3,000 £6,000 trusts generally £1,500 £3,000 below uk higher rate band: The standard deduction for single taxpayers will be.

Source: irs-tax-table.pdffiller.com

Source: irs-tax-table.pdffiller.com

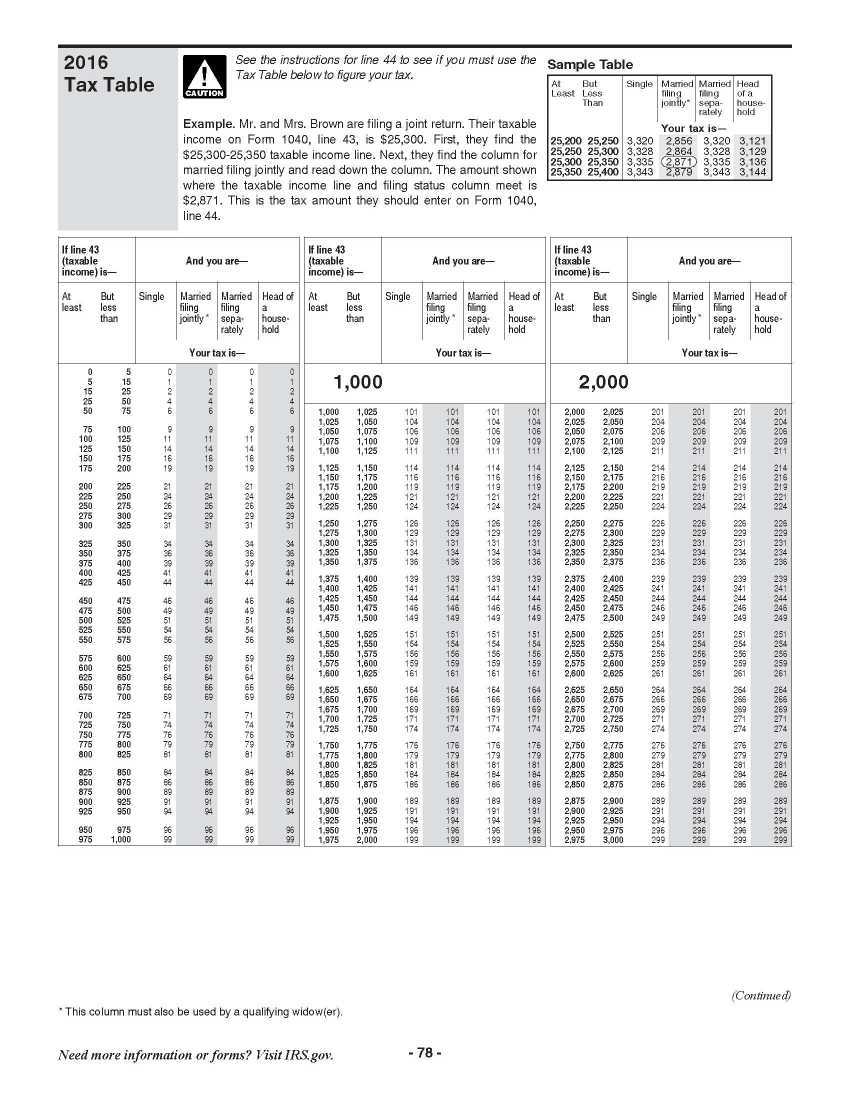

2022 Form IRS 1040 Tax Table Fill Online, Printable, Fillable, Blank, The standard deduction for single taxpayers will be. Tax tables for the 2024/25 tax year here.

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg) Source: tax.modifiyegaraj.com

Source: tax.modifiyegaraj.com

2022 Tax Rate Schedule Irs TAX, Capital gains tax 24/25 23/24 annual exemption: The standard deduction for single taxpayers will be.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

IRS Tax Tables Federal Withholding Tables 2021, The 2024 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2023 tax year. Second payment on account for 2023/24 income tax and class 4 nics.

Source: aubryqgeorgianne.pages.dev

Source: aubryqgeorgianne.pages.dev

2024 Tax Brackets Irs Chart Eula Ondrea, The standard deduction for single taxpayers will be. Second payment on account for 2023/24 income tax and class 4 nics.

Source: eduvark.com

Source: eduvark.com

IRS EZ Tax Table 2023 2024 EduVark, August 2024 1 penalty of 5% of the. Tax tables for the 2024/25 tax year here.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Individuals, estates, etc £3,000 £6,000 trusts generally £1,500 £3,000 below uk higher rate band: The tax information herein is based on laws in effect as of november 21, 2023, for use in filing 2024 income tax returns in 2025.

Source: 1040ezplans.com

Source: 1040ezplans.com

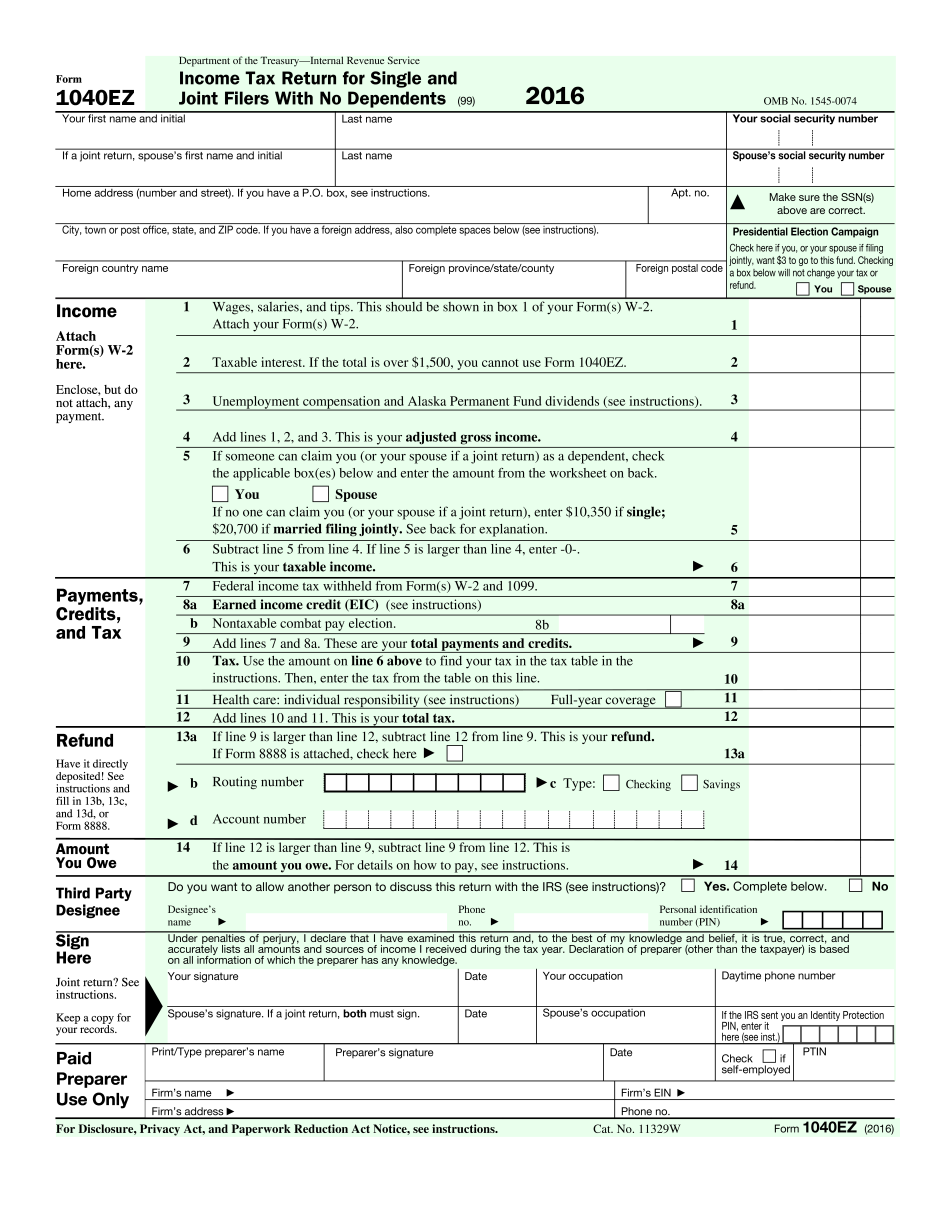

IRS 1040EZ 2024 Form Printable Blank PDF Online, 2024 tax planning tables investment and insurance products: The tax information herein is based on laws in effect as of november 21, 2023, for use in filing 2024 income tax returns in 2025.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T130159 Baseline Distribution of and Federal Taxes; by, This information is for the federal. Capital gains tax 24/25 23/24 annual exemption:

August 2024 1 Penalty Of 5% Of The Tax Due Or £300, Whichever Is The Greater, Where The 2022/23 Tax.

Tax tables for the 2024/25 tax year here.

Individuals, Estates, Etc £3,000 £6,000 Trusts Generally £1,500 £3,000 Below Uk Higher Rate Band:

The standard deduction for single taxpayers will be.

August 2024 1 Penalty Of 5% Of The.

But there are other important tax deadlines to know as well.

Posted in 2024